Oh no.

The B word.

BUDGET.

I truly believe that every family, or individual, should have a budget. Not everyone’s will look the same, but a good, solid starting point will make the world of difference for your marriage and peace of mind. My husband and I are total opposites when it comes to money. He is the “free spirit spender” as I like to call him and I am the saver. I mean, absolutely yes, I like spending money too, but a lot changed for me financially once I gave birth to our son.

We use what is called a Zero-Based Budget.

I know, I know. SNOOZE FEST. :: Get to the part already where you tell me how I get to spend every single dollar!!

It is almost identical to Dave Ramsey’s method. (Ramsey graduated from UT so he must be a genius. GO VOLS!)

A zero-based budget is simple. It means every single dollar that comes into your household that month gets spent. EVERY SINGLE PENNY needs to go into a category. You and your family choose the categories. Just remember: Income – Expenses = ZERO

The most important part is agreeing compromising on what categories are needed and the amounts that go in them. It is absolutely VITAL to sit down with your partner once or twice a month and go over your budget. You might have to do it more often if your income varies, but the key is to decide together.

We sit down the 1st and 15th of every month and make sure the correct amounts for our bills have come out so we can stay on track. We set aside time so we both are sitting in front of our computer with our Excel spreadsheet open and enter in our amounts. There is not much left over for food, gas, and our spending money right now, but it won’t be that way forever.

The most important thing for me right now is staying home with our son, while he is still so young, as much as I can. Our own spending envelopes are just that. OUR VERY OWN.

If my husband wants to spend all his money on beer and fishing lures, GO FOR IT. It’s his spending money to do whatever he wants with it. If I want to spend all my cash in my envelope on donuts and UT GameDay attire, totally fine!

No guilt. No hiding purchases. No secret accounts. No blaming each other or wondering where all the money goes every month. Nothing.

It’s our family budget and we decide where every single dollar goes every single month. This is going to be a process. It won’t happen overnight.

**Budget Tips**

- Stay Organized – use Microsoft Excel to keep your spreadsheet balanced

- Check out Dave Ramsey’s strategy

- Use the Every Dollar website and app to keep track of all your spending

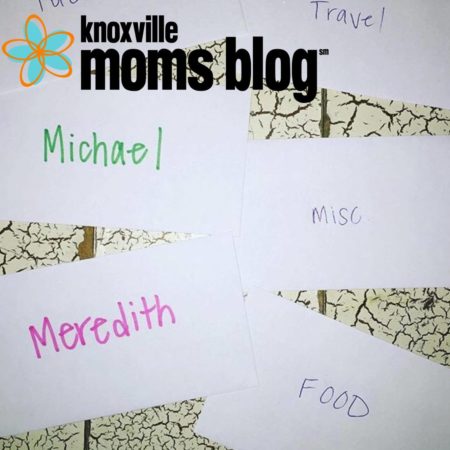

Here is a Generic Template for you to start using!

Income: This is where you include every single dollar of income in your household every single month

- Michael

- Meredith

- Misc

- Total Income

Expenses: These will vary from family to family and should be the FIRST thing you eliminate if one person is trying to stay home full time with the kiddos.

- Rent/Mortgage

- Utilities

- Phone

- Internet

- Cable

- Vehicle

- Boat

- Insurance

- Childcare

- Student Loans

- Credit Card

- Savings

- Total Expenses

Total Income – Total Expenses = Extra money you have left to divide up into all your envelopes

Our CASH envelopes include:

- Michael Spending

- Meredith Spending

- Food

- Gas

- Travel

- Miscellaneous

We use the budget-every-penny method too. I use the app “GoodBudget” to track our envelopes digitally instead of having physical ones because we tried doing cash and it was a little more hassle on us. I love the envelope method though – so it’s nice that there is a digital version! 🙂

Oh, how cool!! Thank for sharing, Sarah! We might have to try that out — it would be a good option if you find yourself struggling to get the cash out. Technology is amazing.

I have a love-hate relationship with our budget but in the end it is soooo nice to see exactly where our money is going. I’ve also grown to LOVE using cash for purchases! We use Dave Ramsey’s app “Every Dollar” to keep track of our budget on a daily basis!

That app is a wonderful idea! I totally feel you on the love-hate relationship. It’s so hard when there is so little leftover to spend on yourself. But, it IS nice to be in control of our finances and meet certain goals and get things we have saved up for! I’m excited for my son to use Dave’s “Spend, Save, Gift” bank!